From this

lesson we are going to learn how we can add any application to the windows

desktop Right-Click Menu/Context Menu. For learning we will show how to add

notepad to the Context menu but you will be able to add any app to this menu

after this lesson.

From this

lesson we are going to learn how we can add any application to the windows

desktop Right-Click Menu/Context Menu. For learning we will show how to add

notepad to the Context menu but you will be able to add any app to this menu

after this lesson.

Adding Applications to the Desktop Context Menu

Step 1:

At first you

have to open “Run” from your Start Menu.

Then write

down “regedit” in the Run Command box and click “ok”. Then go to the following

key:

HKEY_CLASSES_ROOT\Directory\Background\shell

Step 2:

Next, you need

to create a new “key” bellow the “shell” key. Right-click on the ‘shell’ key,

& Select “New” and then select ‘Key’.

Write down a

name which will be shown exactly in the Right Click menu.

Step 3:

Next you’ll

need to create the command key that will actually hold the command used to

launch the application. Right-click on the new Notepad key, and then choose New

> Key from the menu.

Give this

key the name “command” in lowercase.

Step 4:

In this step

you need the full path to that app which one you want to put on the right click

menu. First drag the cursor on that app’s exe file and press Shift +

Right-Click to get the Copy as Path menu item to find this more quickly.

Step 5:

Click on

“command” on the left side, and then double-click on the (Default) key in the

right side to edit the string value.

Paste the

full path of that app which one you copied in step 4 to the “Value data” box.

Once it’s

done, it should look like this:

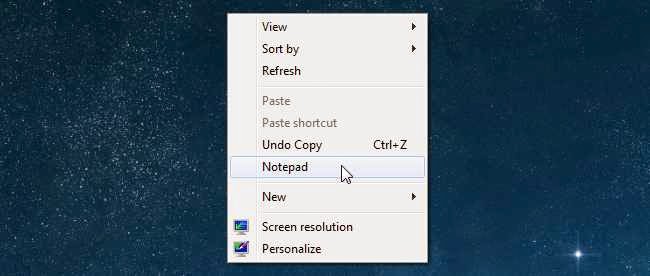

Finally

right click on the desktop now u can see a new menu named by Notepad. Thus you

can add unlimited apps on the right click menu.